Commercial truck depreciation calculator

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. You can purchase a truck costing.

How To Calculate Depreciation Youtube

Select the currency from the drop-down list optional Enter the.

. The recovery period of property is the number of years over which you recover its cost or other basis. Assume that its value will depreciate 30 after the first year and. The calculator is a great way to view.

The tax law has defined a specific class life for each type of asset. Just enter 3 simple values Cost Date Class and get all the answers. 5 year Class life is the number of years over which an asset can be depreciated.

The calculator also estimates the first year and the total vehicle depreciation. C is the original purchase price or basis of an asset. All you need to do is.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. This calculator is for illustrative and educational purposes. As an example depreciation calculation lets say you buy a commercial truck for your business for 100000.

This depreciation calculator will determine the actual cash value of your Trailers using a replacement value and a 15-year lifespan which equates to 015 annual depreciation. Finance Period Months The total length of your loan term in months. The calculator also estimates the first year and the total vehicle depreciation.

Where Di is the depreciation in year i. As a business owner or fleet manager you should keep in mind that the value of your commercial vehicle depreciates as you use it over time. Even better this bonus depreciation is retroactive back to September 27 2017 and works up until.

Depreciation of most cars based on ATO estimates of useful life is. The Payment and Affordability Calculators. Real estate depreciation is a complex subject.

D i C R i. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. 5 years is 60 months.

The calculator allows you to use. It is fairly simple to use. BGC Partners NASDAQBGCP is a combined interdealer.

It is determined based on the depreciation system GDS or ADS used. How many years can I depreciate a truck. The MACRS Depreciation Calculator uses the following basic formula.

Let the Depre123 depreciation calculator take out the guess work. How to Calculate Depreciation on a Rental Property.

Depreciation Of Car Word Problem Solution Youtube

Light General Purpose Truck Depreciation Calculation Depreciation Guru

Car Depreciation Calculator

Bakers Recipe Template Chefs Resources Recipe Template Baker Recipes Recipes

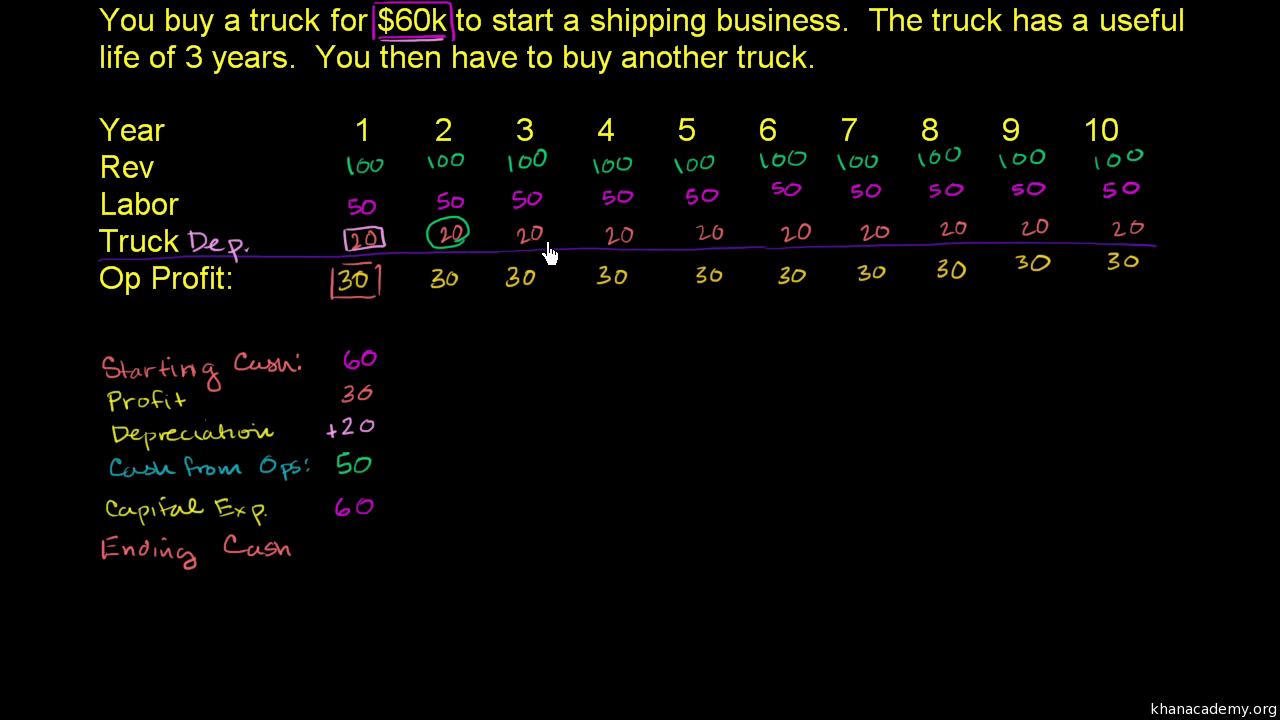

Depreciation In Cash Flow Video Khan Academy

Commercial Truck Resale Values The Latest 2021 Trends Price Digests

Light General Purpose Truck Depreciation Calculation Depreciation Guru

Projected Income Statement 5 Years On Existing Business Income Statement Business Planning Financial Planning

Photography Service Business Plan Laundry Business Laundromat Business Laundry Service Business

Depreciation

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Commercial Vehicle Depreciation Finder Com

Depreciation Formula Calculate Depreciation Expense

Depreciating The Truck Finance Capital Markets Khan Academy Youtube

Depreciation Calculator Depreciation Of An Asset Car Property